News News

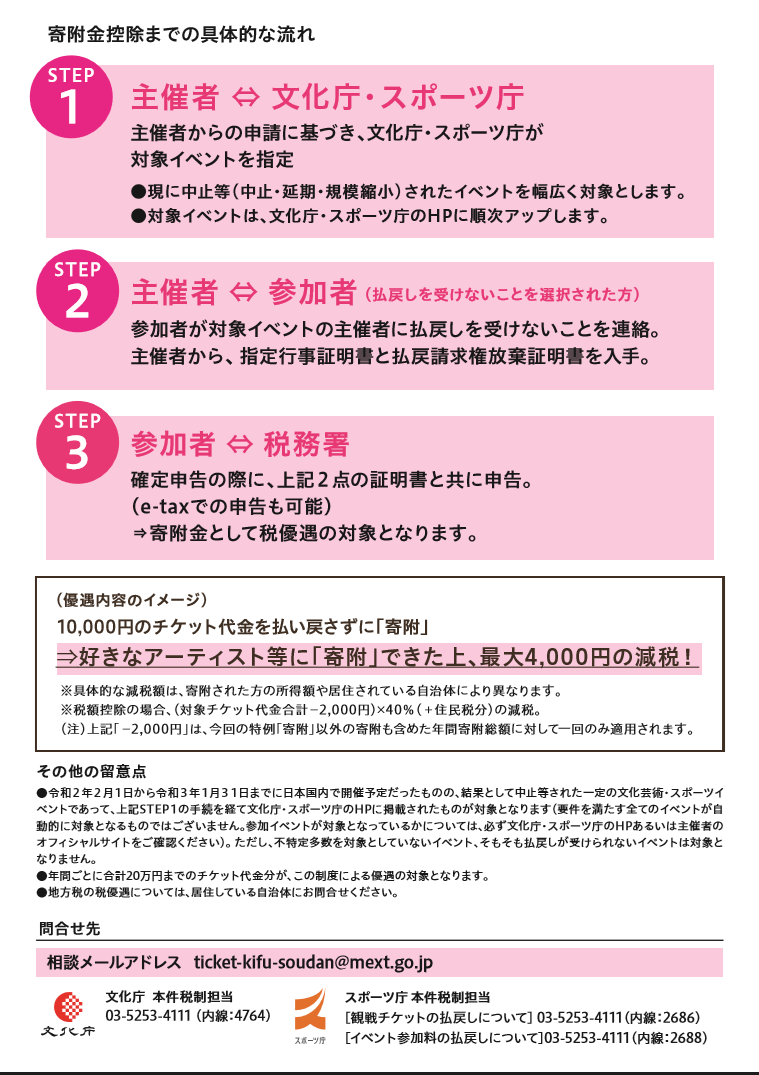

A new tax incentive act has been announced by the government for the guests who wish to donate the tickets instead of requesting refund.

The following concerts sponsored by the Sapporo Symphony Orchestra have been registered as the events recognized by the Minister of Education, Culture, Sports, Science and Technology on May 15. Your donation will be regarded as contribution and the amount you donate would be tax exempted.

■Registered Concerts sponsored by the Sapporo Symphony Orchestra

627th Subscription on March 13 and 14

628th Subscription on April 24 and 25

629th Subscription on May 15 and 16

Sakkyo Symphonic Brass 2020 on May 9

Subscription hitaru concert series Vol. 1 on May 28

■Guests who wish to apply for the tax exemption

Please follow the instruction described below. We will send a certificate that is necessary for the application.

●Guests who purchased a single ticket or Subscription hitaru concert series set of 4 tickets

・Please send your ticket and an information sheet by a letter pack light or by a registered mail.

・On your information sheet, kindly note on the heading that you will waive your right to claim refund. Please also write in your name, address and telephone number.

※Only the volume 1 of Subscription hitaru concert series is applicable.

※Kindly pay your postal fee.

※We will send the certificate before your application of Tax Return.

※Address to send your ticket and informaton sheet: Sapporo Symphony Orchestra c/o Sapporo Concert Hall 1-15 Nakajima-koen, Chuo-ku Sapporo 064-0931.

●For Subscribers, Lucky Friday Members and Smile Friday Members

We will notify you the procedure by our regular newsletter scheduled in June.

The concerts that are not cancelled but postponed are not applicable for this tax exemption.